Boom and Gloom: Is 2022 the Right Time to Invest in Residential Property?

As property markets cool across Australia, investors are beginning to stir. If you’re weighing up your options, you’re probably asking the question on every Australian’s mind: is now the right time to invest in property, or should I wait?

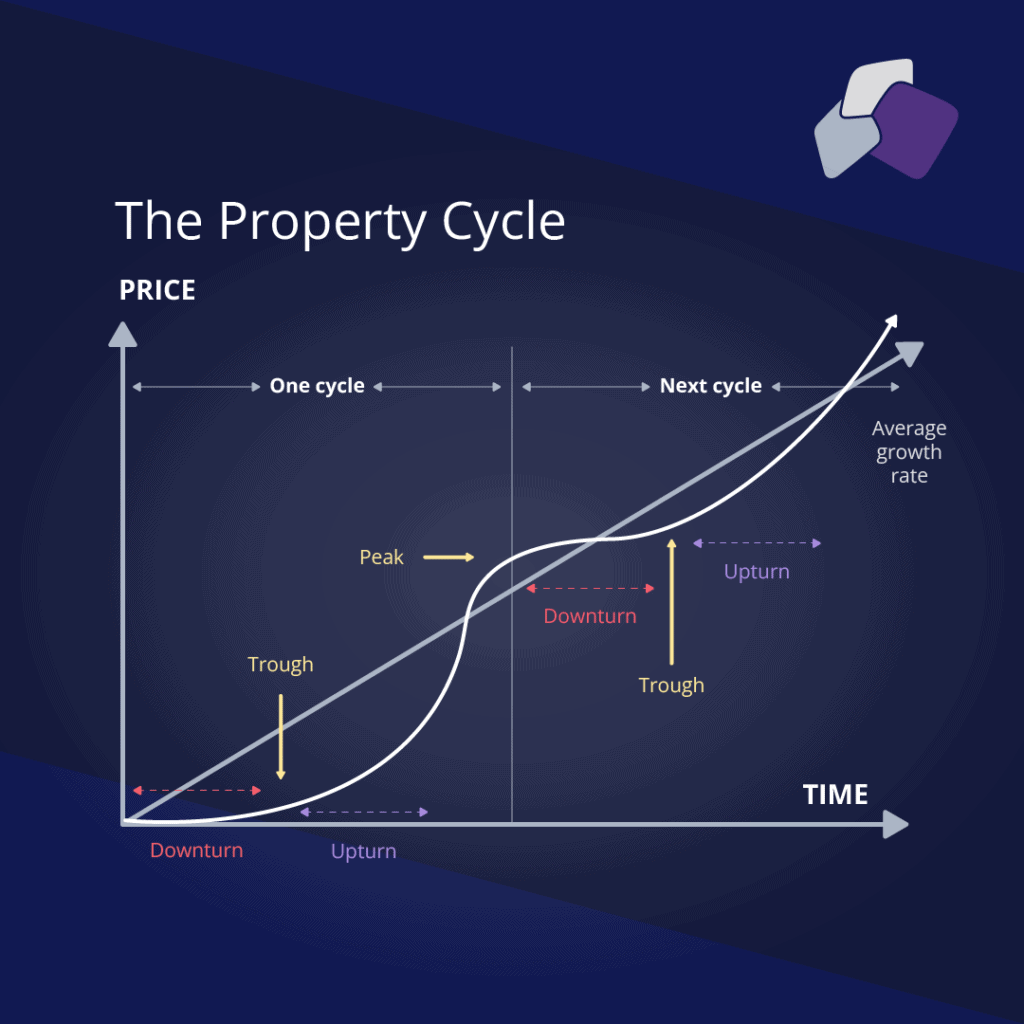

To answer that, we’ll explore the idea of booms and glooms – how property markets swing from upturns and peaks to downturns and troughs, and the difference that good timing can make to investments.

Understanding Property Price Cycles

Over a ten-, twenty- or thirty-year timeline, Australia’s residential property prices are on a steady upwards trend – but that movement is far from linear.

Instead, housing prices move in four-stage cycles: peak, downturn, trough, and upturn. The upturn and peak phases are part of a broader ‘boom’ phase, while the downturn and trough phases represent a ‘gloom’ phase.

It’s a model driven, fundamentally, by supply and demand. When demand is high and supply is limited, prices go up (the boom). To take advantage of increased prices, developers and builders begin to produce more properties. Then, as market supply outpaces demand, prices slump (the gloom), which stimulates demand, driving prices back up again.

There’s No Such Thing As ‘the Property Market’

Of course, ‘supply and demand’ is an oversimplification. Property markets are incredibly complex, with price being driven by a number of different levers, including:

- Interest rates

- Household income

- Building approval and construction rates

- Housing stock

- Population

- Depreciation and demolitions

- House ownership cost

Some of these factors, like interest rates and household income, exist at a national level. Others, like building approval and construction rates, are regional. These regional levers are responsible for geographic discrepancies in property prices, which is why bundling different urban and regional markets together as ‘the Australian property market’ is an unsound approach.

Other trends can also contribute to price movements. For example, one of the drivers behind long-term demand for rental stock is smaller household size, which has decreased from 4.5 people in 1911 to 2.6 people in 2020. Another contemporary trend is the chronic material and labour shortages in the construction sector, which is impeding the delivery of new housing stock into the market.

Even within geographic confines, there are sub-markets – apartments, townhouses and houses, low-, mid- and top-tier price stratifications, urban properties and suburban properties. Each can be affected by a multitude of different factors, including occupancy-related trends (like the drop in international students over COVID) and government policies (like the federal government’s proposed ‘Help to Buy’ scheme). There are always broad national market trends, but sub-markets may deviate or even move in opposite directions.

The Current Australian Property Situation

Across Australia, most capital city housing markets are entering the gloom. According to CoreLogic’s September housing pack, the Melbourne and Sydney markets are continuing to fall, accelerating a downturn that’s spanned the last 12 months. Hobart, Brisbane and Canberra are also slumping, although 12-month indicators suggest that they’re further behind in their cycles than Melbourne and Sydney.

Technical downturns are present in Adelaide and Perth, with 0.1% and 0.2% decreases in dwelling values over August respectively, but their quarterly changes are both positive – it remains to be seen whether they’re experiencing transient dips or are actually heading into the gloom.

Only Darwin is still firmly rooted in a boom phase. With an 6.3% twelve-month uptick and a 0.9% increase over August, prices seem to still be holding at the peak.

Given how closely housing values correlate with interest rates, it seems likely that housing markets will, on average, continue their downwards spiral over the next few months. The RBA is predicting a CPI inflation peak of 7.75% during 2022, which means further cash rate increases are probable – September’s RBA board meeting saw yet another 50-basis-point bump, which pushed the cash rate to 2.35%. Higher interest rates mean home buyers have lower borrowing power, decreasing demand and leading to more available housing stock and lower overall prices.

Considerations for Investors

Investors need to look at two key factors when deciding when to invest: potential for appreciation and rental income.

Potential for Appreciation

There’s a saying common among investors in all markets: “buy in the gloom, sell in the boom.” Investment appreciation is realised when an asset is sold – the greater the positive value change between the buying price and sale price, the more money the investor makes.

As such, buying property during a boom phase may be less than optimal, because the asset is likely to depreciate once the boom is over, which can impact the investor’s ability to unlock equity. Of course, this is entirely dependent on individual investment strategies – investors with a focus on passive rental income or long-term investment horizons may not be affected by a short-term drop in asset value.

Across Australia, most capital city housing markets have entered a gloom phase, opening up opportunities for investors (especially those with shorter investment horizons).

Rental Income

Rental income is also a key consideration for residential property investors. If your investment strategy involves consistent revenue streams, holding a positively geared property is critical; similarly, if you’re investing for capital gains, finding tenants to cover repayment and maintenance costs is still important.

In Australia, rental growth rates are still sitting at 10.1% YoY as of August 2022, and the slowdown in property prices means that, in most markets, gross rental yields are actually recovering (up to 3.29% in August from 2.96% in February).

Those statistics – combined with the interest rate bumps that are keeping housing affordability low – mean that demand for rental properties is still incredibly high. Investors are unlikely to have difficulty finding tenants in most Australian markets.

Is Now the Right Time to Invest?

There is rarely a ‘right’ time to invest. Purchasing property is always a highly individualised decision that should take into account your investment strategy, your personal circumstances, and the recommendations of your property or financial adviser.

Generally speaking, though, there is an opportunity for some investors in the current national market. With interest rates predicted to peak towards the end of 2022, house prices will likely reach the bottom of the trough sometime in 2023. After that, the ascent out of the gloom will begin, so investing now and in the coming months may yield better capital gains than investing after the national market begins to upturn.

Exactly which markets and sub-markets hold the greatest opportunities is a matter for individual investors to discuss with their property advisers. Based on three-month trends to August, the top 25% of residential properties have suffered the sharpest declines in value across every capital city except Hobart, which indicates that this stratification may have higher appreciation potential than the bottom 75% of properties.

There is also still strong lender appetite for home loans (both investor and owner-occupied). Despite tightened lending requirements earlier in 2022, APRA data indicates that interest-only loans and high LTI/DTI loans are currently being originated in volumes either equal to or above March 2019 numbers. With the right broker assistance, investor loans have a strong chance of being approved.

Ultimately, though, the most important thing to remember that property, like all markets, is cyclical. Boom and gloom. Peak and trough. Upturn and downturn. Investing at certain times might be more preferable than investing at others, but it’s the asset, not the timing, that you need to get right.

Invest according to your personal circumstances and investment strategy. Choose a good property that is likely to increase in value over the next decade. Work with your mortgage broker to set up an optimal loan structure. Maintain and renovate your property to increase its value and attract the right tenants.

Those are the fundamentals of property investment. The ephemeral nature of cycles should always be a secondary consideration, not a driver of decisions. Focus on your investment goals, listen to qualified advice, and don’t obsess over booms and glooms.